Introduction to TradingView Software

Master the platform that traders around the world rely on.

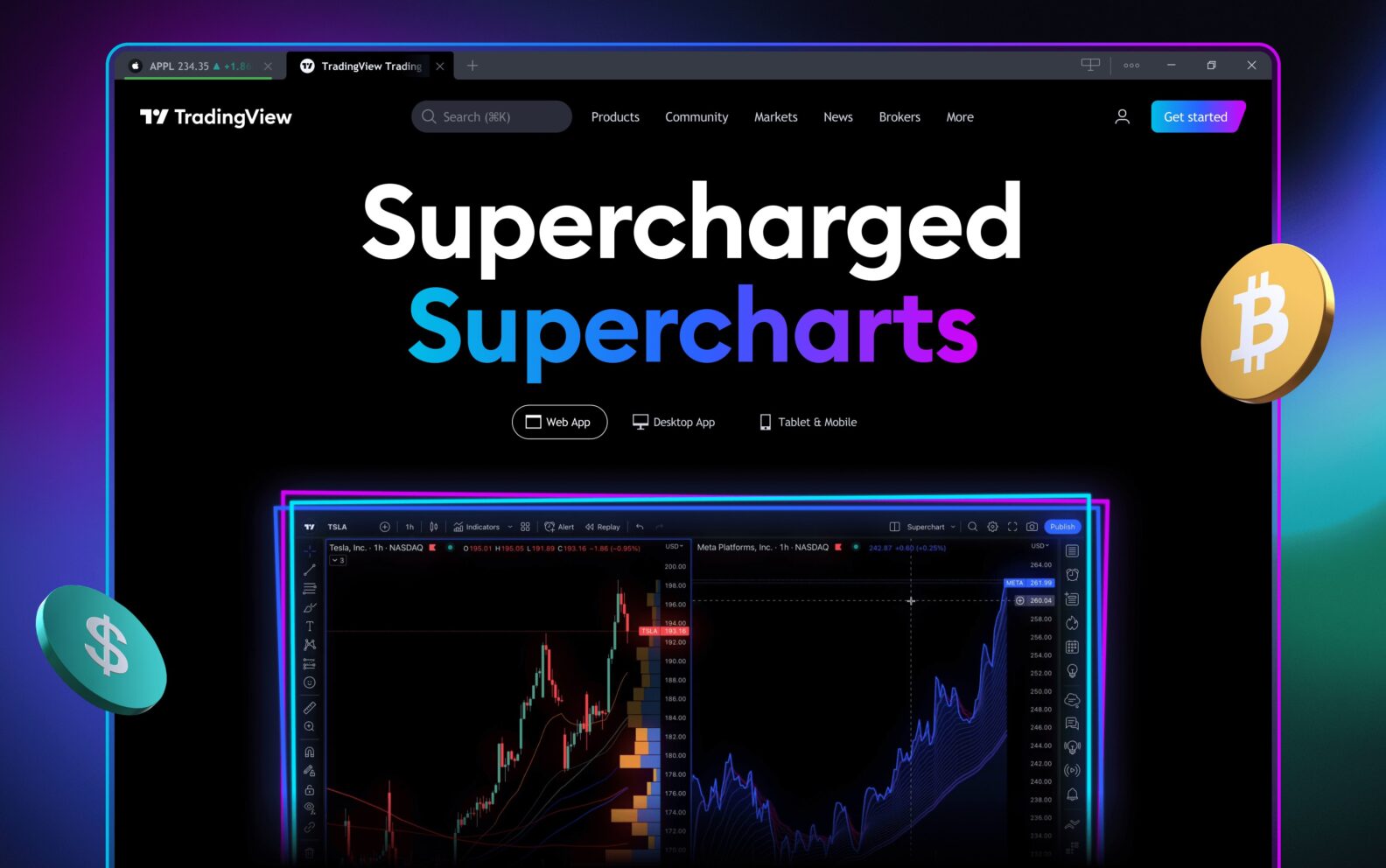

In this beginner-friendly course, you’ll learn how to use TradingView, the world’s leading charting and market analysis software. Whether you’re analyzing forex, stocks, crypto, or indices, TradingView is your visual command center — and this course will teach you how to use it efficiently and professionally.

By the end of the course, you’ll know how to navigate charts, draw tools, apply indicators, manage multiple layouts, set alerts, and build your own strategy templates — all the essentials every trader needs to start strong.

Learning Objectives

By completing this course, you will:

-

Understand the core features and layout of TradingView.

-

Learn how to analyze charts and apply popular indicators.

-

Know how to set alerts, use drawing tools, and save chart layouts.

-

Be able to customize the interface for efficient trading workflow.

-

Build a foundation for strategy testing and journaling within TradingView.

-

Gain confidence to use TradingView for both technical analysis and trade planning.

Want to submit a review? Login